Options trading offers a unique opportunity for investors to leverage market movements, manage risks, and generate consistent income. With the right combination of knowledge, strategic planning, and disciplined execution, options trading has the potential to unlock massive returns while managing risk exposure. In this guide, we’ll take a deep dive into essential options trading strategies, tips, and expert insights that can help you master the art of trading options and maximize your profit potential.

Start your options trading journey with Angel One, a trusted platform for Indian traders.

What Are Options and How Do They Work?

Options are financial contracts that provide the buyer with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, within a specified time frame. These contracts give you leverage, allowing you to control a larger position with a smaller capital outlay.

There are two main types of options:

- Call Options: These grant the buyer the right to buy the underlying asset.

- Put Options: These grant the buyer the right to sell the underlying asset.

Key Uses of Options:

- Speculation: Investors can profit from expected price movements by buying options.

- Hedging: Options can be used to protect an existing portfolio from adverse price changes.

- Income Generation: Traders can sell options to earn premium income.

Important Terms to Know:

- Strike Price: The price at which the underlying asset can be bought or sold.

- Premium: The cost paid to buy an option contract.

- Expiration Date: The last date by which the option must be exercised.

- Intrinsic Value: The difference between the current price of the underlying asset and the strike price of the option.

- Extrinsic Value: The portion of the option’s price that is not intrinsic value, often related to time value and volatility.

Why Expert Options Trading Strategies?

Options trading is not limited to professional investors; it offers a versatile tool for anyone looking to maximize their returns while minimizing risks. Expert options trading strategies is essential for the following reasons:

- Risk Management: Options can act as an effective hedge, protecting your portfolio against unexpected market fluctuations. It also allows you to profit from market volatility, which would otherwise be a risk for long-term stockholders.

- Leverage: With options, you can amplify your exposure to an underlying asset with a relatively small investment. This allows you to control a larger position with less capital.

- Profit Potential: You can earn returns in bullish, bearish, or neutral market conditions. The right options strategy allows you to profit from movements in any direction.

- Flexibility: Options are extremely flexible and can be customized to fit various market conditions and risk profiles. They can be combined to create advanced strategies like spreads, straddles, and butterflies.

- Tax Efficiency: Certain options strategies, especially those involving long-term holdings, may offer tax advantages compared to other forms of trading, depending on your jurisdiction.

To take advantage of expert tools and insights for trading options, sign up with Angel One and get access to advanced trading features for more informed decision-making.

Top Options Trading Strategies

1. Covered Call Strategy

Generate passive income by selling call options against stocks you already own.

- When to Use: In stable or slightly bullish markets.

- How It Works: You own the underlying stock, and you sell a call option against it. This strategy generates premium income but limits your upside potential if the stock price rises above the strike price.

- Example: If you own 100 shares of XYZ stock priced at ₹750, you can sell a call option with a ₹800 strike price. You’ll earn premium income, regardless of small price fluctuations. This strategy works well if you believe the stock price will remain relatively stable.

2. Protective Put

Limit your downside risk by buying put options as insurance for your stock holdings.

- When to Use: When you expect a potential decline in prices but want to hold your stock long-term.

- How It Works: By purchasing a put option, you protect yourself from a potential fall in the underlying asset’s price. The maximum loss is limited to the premium paid for the option, plus any loss in the underlying stock.

- Example: If you own 100 shares of ABC stock priced at ₹1,200, purchasing a ₹1,100 strike price put option will cap your losses at ₹100 per share. This strategy offers peace of mind during periods of high volatility.

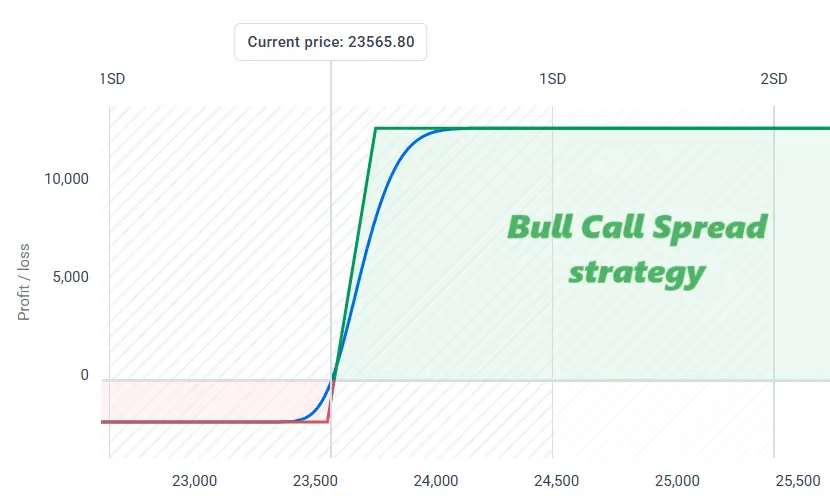

3. Bull Call Spread

Take advantage of moderate bullish trends with reduced risk.

- How It Works: Buy a call option at a lower strike price, and sell another at a higher strike price. This strategy limits both the risk and the reward.

- Example: For DEF stock, you could buy a ₹600 strike price call option and sell a ₹650 strike price call option. This allows you to profit from a rise in stock price while limiting your loss to the net premium paid.

4. Bear Put Spread

Earn profits in a bearish market while limiting your risk exposure.

- How It Works: Buy a put option at a higher strike price and sell one at a lower strike price. The profit potential is limited, but so is the risk.

- Example: Buy a ₹800 strike price put option for GHI stock and sell a ₹750 strike price put option. This strategy profits from a decrease in stock price but limits your loss to the difference between the premiums.

5. Straddle Strategy

Profit from high volatility without predicting the direction of price movement.

- How It Works: Buy both a call and put option with the same strike price and expiration date. This strategy is ideal when you expect significant price movement but are uncertain about the direction.

- Example: For JKL stock trading at ₹900, you could buy both a ₹900 strike price call and put option. If the stock makes a large move in either direction, you can profit.

6. Iron Condor

Generate income in low-volatility markets by combining bull and bear spreads.

- How It Works: Combine a bull put spread and a bear call spread. The goal is for the underlying asset to stay within a certain price range at expiration.

- Example: For MNO stock trading at ₹1,000, sell a ₹1,050 call and ₹950 put while buying protective options beyond these points. If the stock stays between ₹950 and ₹1,050, you can retain the premium income as profit.

Advanced Options Strategies for Seasoned Traders

7. Butterfly Spread

Ideal for traders expecting minimal price movement.

- How It Works: Combine bull and bear spreads with three strike prices. You buy one option at the lowest strike, sell two options at a middle strike, and buy another option at the highest strike.

- Example: Buy one call option at ₹950, sell two call options at ₹1,000, and buy another call option at ₹1,050. This strategy profits when the stock price remains around ₹1,000 at expiration.

8. Calendar Spread

Profit from time decay by using options with different expiration dates.

- How It Works: Buy a long-term option and sell a short-term option at the same strike price. This strategy benefits from the time decay of the short-term option.

- Example: Buy a call option expiring in three months and sell a call option expiring in one month, both at the same strike price. As time passes, the short-term option will lose value faster than the long-term option.

9. Ratio Spread

Create a net credit by selling more options than you buy.

- When to Use: When you expect limited price movement with a slight bias in one direction.

- Example: Buy one call option at ₹1,000 and sell two call options at ₹1,050. This creates a net credit but increases risk if the stock price moves far beyond the higher strike price.

Key Tips for Successful Options Trading

- Understand the Greeks

Options pricing is influenced by the Greeks, which are key factors that affect how the price of an option changes over time. These include:- Delta: Measures the price sensitivity of an option to changes in the underlying asset.

- Theta: Tracks the time decay of an option as it approaches expiration.

- Vega: Indicates the sensitivity of an option’s price to volatility.

- Gamma: Represents the rate of change of delta.

- Use Effective Risk Management

- Set Stop-Loss Orders: Set predefined exits to limit your losses and protect your capital.

- Portfolio Allocation: Limit your exposure to options to a small percentage of your overall portfolio. Avoid putting all your eggs in one basket.

- Avoid Overleveraging: Stay disciplined and never overextend your position, as this can lead to significant losses.

- Stay Informed and Prepared

- Market Analysis: Use tools like option chain analysis, technical analysis, and implied volatility charts to understand market trends.

- Economic Events: Monitor interest rate decisions, geopolitical events, and earnings reports, as these can dramatically impact options pricing.

For more powerful stock market analysis and expert insights, check out StockEdge. It’s an excellent platform for Indian traders looking to sharpen their stock market strategies and enhance their investment knowledge.

Common Mistakes to Avoid

- Overtrading: Focus on quality over quantity. Trading too frequently can lead to unnecessary losses.

- Ignoring Volatility: Misjudging volatility can lead to significant losses. Make sure you understand how volatility impacts options pricing before entering a trade.

- Skipping Research: Always do thorough research on the underlying asset and market conditions before executing any trade.

- Unrealistic Expectations: Avoid expecting every trade to be profitable. Set realistic profit targets and accept losses as part of the process.

Tax Implications of Options Trading in India

In India, options trading falls under the category of capital gains tax. The tax treatment depends on the holding period of the options:

- Short-Term Capital Gains: If you hold the options for less than 12 months, the gains are subject to a 15% tax.

- Long-Term Capital Gains: If you hold the options for more than 12 months, the gains are taxed at the normal income tax rate.

It’s crucial to keep track of your options trades and consult with a tax professional to ensure compliance and optimize your tax strategy.

Conclusion: Become a Successful Options Trader

Options trading is not only about making quick profits—it’s about creating a systematic, disciplined approach that helps you manage risks and achieve consistent returns. By leveraging the right strategies, practicing sound risk management, and staying informed about market trends, you can take your options trading skills to the next level.

Start small, educate yourself continuously, and use simulated trading accounts to practice strategies before trading with real capital. With time, patience, and a focus on learning, you can potentially unlock tremendous opportunities in the world of options trading. For more foundational stock market investment strategies in India, check out our Stock Market Investment India Guide to further enhance your knowledge and broaden your investment horizons.

Q&A: Options Trading

Q1. What are the key benefits of options trading for investors?

A: Options trading offers several advantages:

- Leverage: Control larger positions with a smaller capital outlay.

- Risk Management: Hedge your portfolio against market volatility.

- Income Generation: Earn premiums through strategies like covered calls.

- Profit Potential: Capitalize on bullish, bearish, or neutral market trends.

- Flexibility: Tailor strategies (e.g., spreads, straddles) to fit various risk profiles and market conditions.

Q2. Which options trading strategy is best for beginners?

A: Beginners can start with simple, risk-managed strategies:

- Covered Call: Generate income by selling call options against stocks you own.

- Protective Put: Protect stock holdings from potential losses by buying put options.

- Bull Call Spread: Profit from moderate upward trends while limiting losses.

These strategies allow beginners to learn while managing risks effectively.

Q3. How can Indian traders make the most of options trading?

A: Indian traders can follow these best practices:

- Trade during optimal hours (9:15 AM to 3:30 PM IST) for maximum liquidity.

- Use weekly options expiries to benefit from rapid theta decay for short-term gains.

- Focus on sector-specific options (e.g., IT, banking, FMCG) to align trades with market trends.